Emerging-Market Selloff Accelerates on Fed Outlook

Aug 07, 2015

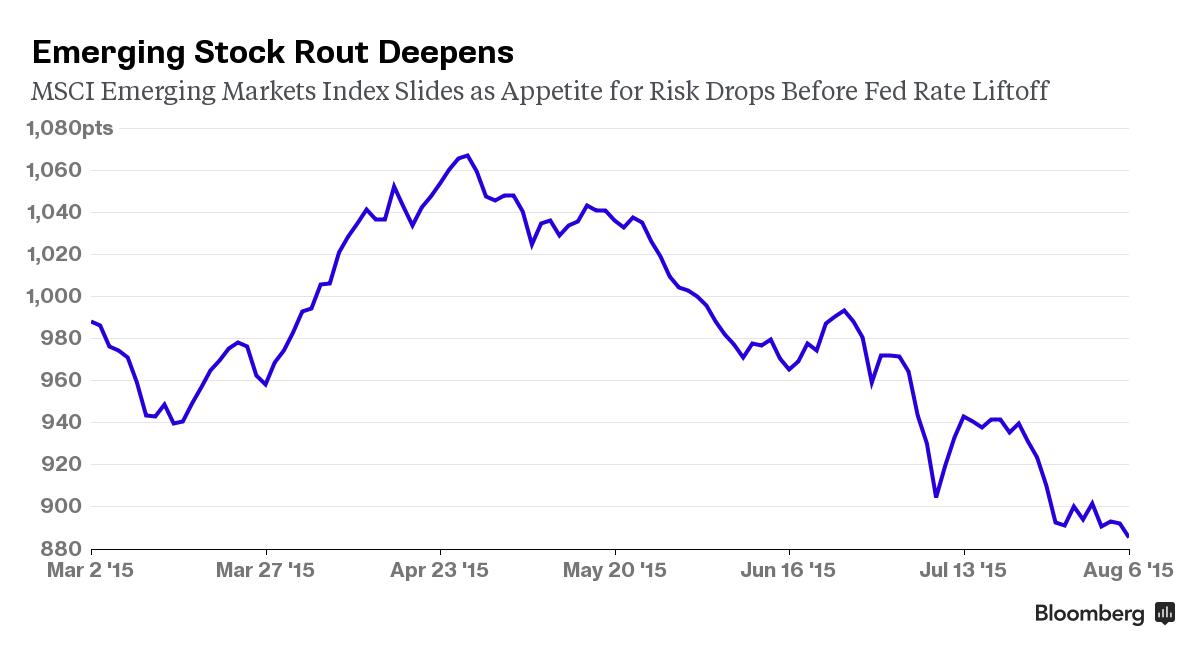

A selloff in emerging-market assets accelerated as currencies deepened their slump against the dollar amid mounting speculation that a U.S. interest-rate increase is imminent and energy stocks tumbled with oil prices.

Russia’s ruble fell for a second day as crude, the country’s biggest export, sank on concern a global supply glut will be prolonged. Brazilian bond yields rose to a record as President Dilma Rousseff suffered a setback in Congress that eroded measures to pare budgets and avoid a junk credit rating. The MSCI Emerging Markets Index traded at a more than two-year low as energy companies tumbled.

Developing-nation stocks, bonds and currencies have been dragged down by growing evidence that the U.S. economy is improving enough to embolden the Federal Reserve to raise borrowing costs for the first time since 2006 as soon as next month. The Fed’s near-zero interest rates have supported demand for riskier assets in emerging nations. Data on Thursday that showed filings for U.S. unemployment benefits near four-decade lows further bolstered the case for an increase.

“Rising interest rates in the U.S. should mean that capital flows to emerging markets will remain under pressure,” Maarten-Jan Bakkum, a senior emerging-markets strategist at NN Investment Partners in The Hague, said by e-mail.

Traders have never been more convinced of a September rate rise by the Fed, betting on a 52 percent chance of an increase in September on Wednesday, up from 38 percent just two days earlier.

Russia, Brazil

The MSCI Emerging Markets Index declined 0.8 percent to 884.93 in New York, the lowest since June 2013, as a Bloomberg gauge tracking 20 currencies slumped 0.1 percent, falling to a record for a sixth straight day. The premium investors demand to hold emerging-market debt over U.S. Treasuries widened five basis points to 371 basis points, according to JPMorgan Chase & Co. indexes.

The ruble weakened 0.9 percent against the dollar to the lowest level since February. Brent for September settlement, the oil grade traders use to price Russia’s main export blend, dropped 7 cents to end the session at $49.52 a barrel on the London-based ICE Futures Europe exchange. It touched $48.88, the lowest since Jan. 30. The dollar-denominated RTS Index of Russian stocks dropped 2.8 percent, ending a two day advance.

Yields on 10-year real-denominated Brazilian government bonds sold in the local market surged to a record 13.75 percent and the currency weakened 1.4 percent in a sixth straight decline. The worst economic contraction in 25 years, an escalating political scandal and a shift by the central bank to refrain from increasing interest rates have pushed the real down 26 percent in 2015, the most in the world.

Energy Stocks

An MSCI gauge of developing-nation energy companies fell 1.2 percent, helping lead losses among 10 industry groups. Gazprom PJSC, the Russian natural-gas producer, led declines, dropping 2 percent. Brent crude has slumped about 27 percent this year’s high in May.

Shares in Saudi Arabia, the world’s largest oil exporter, fell 1.6 percent. The country plans to sell as much as 20 billion riyals ($5.3 billion) of debt on Monday as the OPEC producer seeks to plug its budget deficit after oil prices plunged, two people familiar with the matter said.

Malaysian stocks tumbled 1.8 percent, the most this year. The ringgit slid 0.9 percent to the lowest level since 1998 on concern the nation’s foreign-exchange reserves dropped to the lowest level since the 2008 global credit crunch, reducing ammunition to defend the region’s worst-performing currency.

In Taipei, Largan Precision Co. sank 9.9 percent after a report showed weakening sales prospects, while the Shanghai Composite Index retreated for a second day amid growing concern that unprecedented government intervention will fail to stop an equity rout.

Source: Bloomberg Business